International freight is no longer just “weight × unit price.” It is a dynamic, multi-layered system shaped by geopolitical shifts, regulatory reforms, and supply chain innovations. Understanding its structure is critical for cost control and competitive advantage. Here’s how global logistics costs are evolving in 2025 and how leading businesses are adapting.

Ocean Freight:

Pricing Models: Full Container Load (FCL) rates remain container-based, while Less than Container Load (LCL) uses Revenue Tons (chargeable weight/volume, whichever is higher).

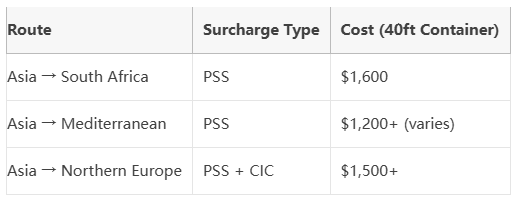

Surcharges Dominate: Fuel Adjustment Factors (BAF) and Peak Season Surcharges (PSS) now account for 30–60% of total costs. Example: Maersk’s August PSS hikes reach $1,600/40ft container on Asia–Africa routes.

Air Freight & Express:

Volumetric Weight Rules: IATA’s formula (L×W×H cm / 6000) penalizes low-density shipments. Carriers like DHL impose frequent fuel surcharges (linked to jet fuel indexes).

Ground Transport:

U.S. LTL Revolution: The NMFC reform prioritizes density-based pricing (e.g., 50+ lb/ft³ = Class 50). This disrupts FAK agreements and demands packaging optimization to avoid cost spikes.

Transpacific Rate Surge: Spot rates hit $6,000–7,000/FEU (Asia–USEC), fueled by frontloading ahead of Trump’s August 1 “reciprocal tariffs”.

SCFI Index Drops 5%: Despite declines on Europe routes, carriers impose PSS to stabilize profits.

Amazon FBA Adjustments:

Europe: Lower fulfillment fees for 7 new parcel tiers + free returns for bags/backpacks.

U.S.: Storage fees up 26%, with stricter aged-inventory penalties (auto-removal at 270 days).

Table: Major Carrier Surcharges

Repackage for Density: Increase goods density above 35 lb/ft³ to qualify for lower NMFC classes (e.g., Class 55).

Dynamic Routing: Adopt AI tools (like SHEIN’s LOG-AI) to bypass congested ports and tariff zones. Case: Turkey–Bulgaria land-air hybrid cuts Europe-bound costs by 19%.

FTA Networks: Manufacture in tariff-friendly hubs (e.g., SHEIN’s Turkey/Mexico factories cut duties from 12% to 3%).

IOSS Compliance: For EU VAT, use platforms’ Import One-Stop Shop to avoid clearance delays.

Amazon FBA:

Shrink packaging to fit lower fee tiers (e.g., Europe’s “Medium Parcel 1” saved 10.6% in UK trials).

Offload aged stock pre-penalty (U.S.: 270 days; Europe: 241 days).

Diversify Carriers: Book with mid-sized lines avoiding PSS-heavy lanes; use freight forwarders for ALL-IN quotes.

Real-Time Visibility: Track surcharge announcements (e.g., Maersk’s 7–14-day PSS notices).

Cargo Insurance: Essential as base carrier liability covers <10% of high-value shipments.

Tech Integration:

Blockchain for HS code accuracy and duty savings.

AI stowage algorithms (92% container utilization).

2025’s freight landscape demands agility: Monitor tariff calendars (e.g., August 1 U.S. changes), redesign packaging for density rules, and automate routing. Companies like SHEIN prove that integrated logistics strategies—combining tax engineering, data analytics, and multi-modal transport—can turn volatility into advantage.

“The winners aren’t those who pay the lowest base rates, but those who master the art of total landed cost control.”

Reach out for a personalized freight structure analysis tailored to your 2025 shipment profiles.