Supply chains face unprecedented disruptions as port congestion reaches critical levels during the 2025 peak season.

Global port congestion has intensified during this year's peak shipping season, creating widespread supply chain disruptions and driving up logistics costs. Current data indicates approximately 10% of global container capacity is currently affected by port delays across major trade routes.

This crisis stems from multiple factors: ongoing Red Sea diversions, vessel upsizing trends, infrastructure limitations, and sudden shifts in global trade patterns.

Singapore experiencing 7-day vessel wait times, up from historical average of 0.5 days

Rotterdam container dwell times extended to 6-9 days due to European port congestion

Los Angeles/Oakland complex facing 3-4 day delays amid West Coast labor challenges

Global average vessel wait times have increased by 40% compared to 2024 peak season

135 vessels currently queued outside Shanghai-Ningbo port complex

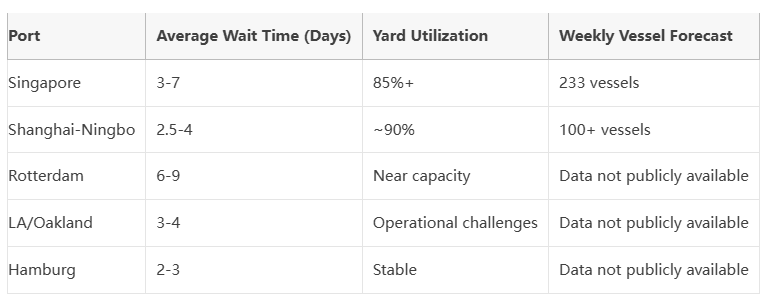

September has brought intensified congestion across global supply chains, characterized by extended vessel wait times, container dwell times, and yard utilization rates.

The congestion is creating ripple effects across global logistics networks, resulting in: soaring freight rates, equipment shortages, and increased landside transportation pressures.

Singapore Port, the world's second-largest container port, is experiencing severe congestion. January-April 2025 statistics show the port handled 14.18 million TEUs, representing 6.1% year-on-year growth.

Current vessel wait times have extended to approximately 7 days compared to the typical half-day turnaround. Transshipment cargo requires 7 days, while import and export cargo need 3 and 2 days respectively.

Chinese Main Ports are facing similar pressures. Shanghai, Ningbo, and Qingdao are experiencing unprecedented vessel arrivals. The Shanghai-Ningbo anchorage currently has 135 vessels waiting for berth space.

According to EconDB data, export containers at these ports require 2.5-4 days average waiting time before loading.

Rotterdam Port reported a 4.1% throughput decrease in H1 2025, though container volumes grew 2.7% to 7 million TEUs, maintaining its position as Europe's largest container port.

Export containers face 6-day delays while transshipment cargo requires 9 days. Port authorities noted "exceptional congestion in handling container flows due to various factors."

Antwerp-Bruges Port has seen container dwell times increase from 5 to 7-8 days. Yard operations require frequent repositioning to locate containers, leading to increased operational errors due to workforce and equipment strain.

US West Coast ports are experiencing increased inspections and warehouse capacity issues. Los Angeles/Oakland complex faces 3-4 day delays, while Miami reports approximately 2-day delays.

Seattle, Baltimore, and Norfolk ports are seeing increased customs scrutiny, particularly focused on cargo value and importer compliance. Los Angeles port reported double-digit percentage volume decreases in May.

Global Major Port Congestion Comparison

Multiple factors are contributing to the global port congestion crisis:

Red Sea Diversions: Ongoing security concerns have forced vessels to reroute via the Cape of Good Hope, disrupting global sailing schedules and causing unexpected vessel arrivals.

Infrastructure Limitations: Port expansion projects are failing to keep pace with vessel upsizing trends and sudden trade flow changes.

Labor Challenges: European port strikes have caused significant disruptions across Rotterdam, Hamburg, and Le Havre.

Weather Events: Typhoon season in Asia and extreme weather patterns are causing additional operational disruptions.

Shippers are implementing creative routing strategies to bypass congested hubs:

Asia-Europe Trade: Consider Mediterranean alternatives instead of traditional Northern European hubs. MSC has redirected its largest 24,000+ TEU vessels from Northern Europe to Mediterranean and West Africa routes.

However, industry analysts caution that "such route adjustments may simply transfer congestion problems to alternative ports." Mediterranean ports including Barcelona, Genoa, and La Spezia are already experiencing increasing delays.

Trans-Pacific Trade: Explore Canadian or Mexican gateway options. When West Coast ports are skipped, consider routing via Prince Rupert or Vancouver, then utilizing rail connections to final destinations.

Regional Transshipment: Utilize Southeast Asian hubs for initial discharge, then complete final leg with regional feeders.

When carriers omit scheduled port calls due to congestion, weather, or capacity adjustments, implement these emergency measures:

Multimodal Re-routing: Immediately activate alternative transport combinations using rail, barge, and trucking options. Critical assessment of alternative port capacity is essential - if congestion exceeds threshold levels, implement regional transshipment strategy.

Cost Control & Legal Protection: Within 48 hours of schedule change, activate dual-track approach. Negotiate cost sharing under force majeure clauses while simultaneously initiating competitive bidding among alternative carriers.

Digital platforms provide crucial visibility and flexibility during disruptive periods:

Real-time Tracking Systems: Offer immediate cargo visibility and early disruption detection, enabling proactive customer communication.

AI-powered Freight Comparison Tools: Revolutionize route planning and carrier selection by analyzing multiple options based on transit time, cost, and reliability metrics.

These digital solutions enable data-driven decision making and help mitigate port congestion impacts.

Beyond immediate responses, these long-term strategies build supply chain resilience:

Diversified Routing: Avoid over-reliance on single ports or carriers. Develop multi-port strategies across different regions.

Enhanced Collaboration: Strengthen communication between shippers, carriers, and port authorities to collectively address congestion challenges.

Visibility Investments: Implement end-to-end supply chain visibility solutions for early disruption detection.

Inventory Strategy Adjustment: Increase lead times and buffer stock where possible to accommodate potential delays.

Singapore Transport Minister Chee Hong Tat noted that January-April 2025 container throughput growth of 6.1% demonstrates the port's continued competitive strength despite current challenges.

Rotterdam CEO Boudewijn Siemons stated, "In recent months, we have faced economic uncertainty, delayed investments, and supply chain disruptions as a port."

Digitalization and intermodal solutions are becoming critical tools for managing congestion. Rotterdam has successfully limited the number of waiting container vessels through improved coordination.

Future supply chain competition will prioritize resilience, visibility, and flexibility alongside traditional cost and time considerations.