Navigating U.S. CBP Policy Updates 2025: A Practical Guide to Declarations, HS Codes & Duty Estimation

Critical 30-day compliance window: One misstep could trigger 50% punitive tariffs or customs delays.

Between late July and early August 2025, U.S. Customs and Border Protection (CBP) and the White House rolled out sweeping policy changes affecting de minimis shipments, copper product tariffs, and Overflight Exemption procedures—fundamentally altering import operations and supply chain economics.

Starting August 29, nearly all sub-$800 packages lose duty-free status. Semi-finished copper products face 50% tariffs, while digital Overflight Exemption processing promises faster approvals.

This guide unpacks critical changes, provides actionable compliance steps, and reveals strategic workarounds.

1. De Minimis Exemption Eliminated

Effective August 29, 2025, all non-postal commercial shipments under $800 will be subject to either:

Ad valorem duty: Standard IEEPA rate based on country of origin

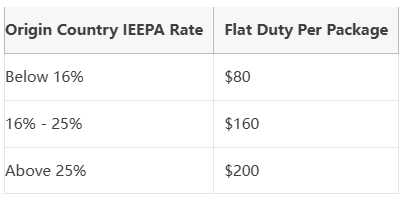

Flat-rate duty: Tiered fee per package (see chart below)

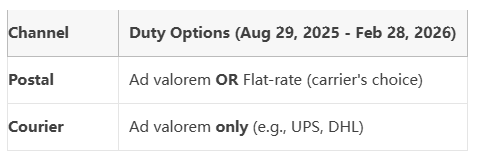

Postal operators may choose either method until Feb 28, 2026 (after which ad valorem applies)

Non-postal carriers (e.g., FedEx/DHL) must use ad valorem only

2. 50% Copper Tariff Enforcement

Since August 1, semi-finished copper products (HTSUS 9903.78.01) incur 50% duties. Importers must:

File separate customs entries for copper vs. non-copper components

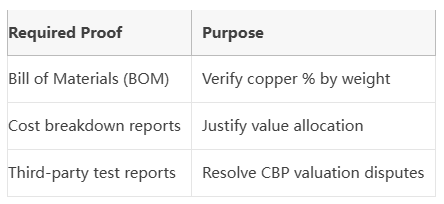

Maintain detailed supporting documents (BOMs, invoices)

Risk: Failure to split components triggers 50% duty on full value

3. Streamlined Overflight Exemptions

CBP migrated Overflight Exemption applications/renewals to eAPIS platform with <30-day processing. Operators must:

Ensure international carrier bonds and fees are current

Authorize third-party agents via ACE portal

Step 1: Determine Shipping Method & Duty Type

Step 2: Calculate Duties

Ad valorem: Item value × IEEPA rate (e.g., $100 item at 10% = $10 duty)

Flat-rate: Apply tiered fee based on origin country's IEEPA rate

Step 3: Handle Special Goods

Shipments subject to AD/CVD or quotas require full ACE e-filing regardless of value. Non-compliance risks holds/delays.

Step 4: Optimize During Transition (Until Feb 2026)

Compare duty methods monthly (carriers can switch with 24h notice)

Pro tip: Flat-rate often cheaper for high-value items from low-tariff countries (<16% IEEPA)

Accurate HS code assignment now directly impacts duty costs:

Copper Product Classification

Composite goods: Split entries required

Copper portion: HTSUS 9903.78.01 (50% duty)

Non-copper: HTSUS 9903.78.02 (0% duty)

Pure copper: Single entry at 50% duty

Critical Exceptions

Dual-eligible items (e.g., auto parts with copper) default to auto tariff rules

IEEPA reciprocal exceptions (HTSUS 9903.01.33) require active claiming

Origin Declaration Requirements

All postal shipments must declare country of origin—basis for IEEPA rates. Errors may cause:

Underpayment (e.g., $200 flat duty applied as $80)

Penalties up to 300% of owed duties

Entry Splitting Protocol

Split copper/non-copper values at invoice line-item level

Value copper content per "transaction value" method (WTO Valuation Agreement)

Documentation Essentials

Immediate Actions (Aug-Dec 2025)

Audit high-volume products for copper content

Model shipping cost scenarios: Postal vs. Courier + duty options

Explore sourcing shift to sub-16% IEEPA countries (e.g., Australia, UK)

Long-Term Compliance Framework

Implement automated classification tools (e.g., Descartes Tariff Management)

Develop bonded manufacturing strategies for copper-intensive goods

Retain CBP-licensed brokers with new regulation expertise

Policy Developments to Watch

Expanded copper derivative list coming Q4 2025

CBP's new AI system: Aggregates multiple shipments to same importer to detect $800 threshold breaches

Potential IEEPA base rate increase to 15-20% in 2026

CBP’s overhaul signals a new era of digitized, high-cost U.S. imports. With de minimis expiration (Aug 29) and copper tariffs already active, proactive compliance is non-negotiable.

Prioritize these 3 tasks immediately:

Recalculate landed costs under new duty structures

Optimize shipping channel mix (leverage postal flexibility until Feb 2026)

Implement origin tracing protocols

In this regulatory revolution, businesses that master operational details will secure both cost efficiency and supply chain resilience.