Optimize your global supply chain with strategic warehouse placement. Data-driven insights for informed decision-making.

In today's evolving global commerce landscape, strategic warehouse placement has become critical for building resilient and efficient supply chains. According to 2024 industry data, businesses implementing specialized overseas warehouse solutions reduce overall logistics costs by 35% on average while improving order fulfillment speed by 55%.

This comprehensive analysis examines North America, Europe, and Southeast Asia's key markets through multiple lenses: regional competitiveness assessment, location evaluation frameworks, and total cost of ownership analysis.

Key Advantages:

Market Coverage & Efficiency: Major logistics hubs (Los Angeles, New York) enable 72-hour delivery to 75%+ of densely populated areas

Infrastructure Maturity: 68% automation penetration in warehouse facilities with seamless UPS/FedEx integration

Regulatory Clarity: Standardized customs processes with transparent tax structures

Operational Considerations:

Premium warehouse rates 3.8x higher than Southeast Asia

Labor costs represent 35-40% of total operational expenses

Requires ongoing monitoring of Section 301 tariff provisions

Best For: High-value products (>$80), time-sensitive supply chains, B2B manufacturing clients

Key Advantages:

High Purchasing Power: $45K per capita spending capacity with strong demand in industrial equipment and renewable energy

Multimodal Connectivity: Rotterdan-Antwerp port cluster combined with rail networks enable 48-hour pan-European delivery

Tax Efficiency: 90-day import VAT deferral available through bonded warehouse systems in Benelux countries

Operational Considerations:

Must comply with 17+ regulatory requirements (GDPR, CE, EPR)

Green facility modifications require 15-20% additional investment

Complex certification processes for specialized products

Best For: Precision instruments, medical devices, premium consumer goods requiring strict certification

Key Advantages:

Cost Efficiency: Total warehouse costs 75-80% lower than Western markets with abundant multilingual talent

Trade Agreement Benefits: 8.5% average tariff reduction through RCEP cumulative rules of origin

Growth Potential: 24% CAGR in digital retail with rising demand for consumer electronics and FMCG

Operational Considerations:

25% delay rate during monsoon season in certain markets

Requires local contingency planning for regulatory changes

Variable infrastructure quality across region

Best For: Small parcels (<5kg), fast-moving consumer goods, e-commerce fulfillment

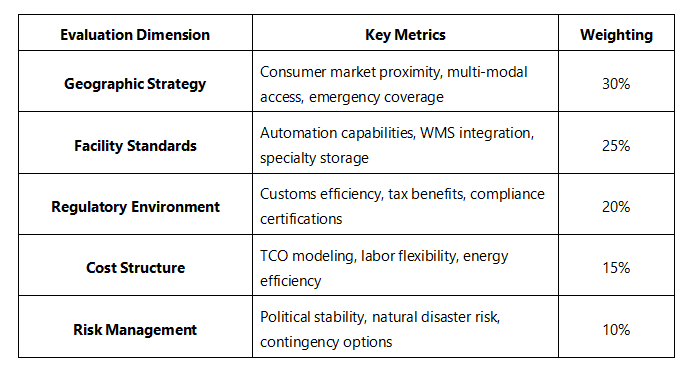

Our data-driven evaluation model assesses warehouse locations across five critical dimensions:

Implementation Methodology:

Phased Deployment Approach

Initial pilot: 800-1000㎡ facilities in stable markets (Malaysia, Netherlands)

Expansion phase: Add regional hubs (Dallas, Duisburg)

Optimization: Develop hub-and-spoke network with 3-5 core facilities

Compliance Preparation

Allow 120 days for European EPR registration and VAT processing

Ensure FDA/FCC compliance for North American shipments

Performance Monitoring

Quarterly reviews of 12 KPIs including inventory turnover and order accuracy

Comprehensive Cost Structure:

Facility Costs (40-45%): Rent, depreciation, utilities

Operational Costs (30-35%): Labor, systems, materials

Compliance Costs (15-20%): Certifications, tax filing, modifications

Risk Management (5-10%): Insurance, contingency reserves

Volume Weight Optimization:

Our advanced algorithms significantly reduce large-item shipping costs through optimized dimensional weight calculations:

Chargeable Weight = MAX(Actual Weight, (L×W×H)/Density Factor)

Standard courier density factor: 5000

Our optimized factor: 6000-7000

Case Example: Fitness equipment (100×80×60cm, 45kg actual weight)

Standard: 100×80×60/5000 = 96kg → $478

Our solution: 100×80×60/6500 = 73.8kg → $368

Result: 23% cost reduction

We provide data-driven warehouse placement and container consolidation solutions that deliver 30-40% total supply chain cost reduction.

Value Proposition:

Economies of Scale: 15-25% discounted rates through volume-based carrier negotiations

Smart Consolidation: Patented loading algorithms increase container utilization by 18%

Packaging Engineering: <0.3% damage rate through transport dynamics analysis

Resource Sharing: 45% reduced capital expenditure through flexible capacity model

Strategic Partnership: Priority space allocation and fixed pricing for annual contracts

End-to-End Service Flow:

Requirement Analysis: Detailed SKU and logistics pattern assessment

Solution Design: Customized network architecture and route optimization

Execution Management: Real-time visibility with 15-minute incident response

Continuous Improvement: Quarterly business reviews with data-driven optimization

Challenge: Solar equipment manufacturer facing:

18% product value in logistics costs

11-day average customs delays in Europe

<2.5 annual warehouse turnover in North America

Our Solution:

Reconfigured network with dual hubs (LAX+DFW) and tax-optimized European layout

Streamlined EU certification process reducing clearance to <3 days

Implemented 7000 density factor and custom loading solutions

Results:

38.7% total supply chain cost reduction

European fulfillment cycle reduced from 14 to 5 days

Warehouse turnover increased to 4.2 annually

Customer satisfaction reached 96.5% with 13.2% market share growth

Strategic warehouse placement requires balancing cost efficiency with risk management. North America demands infrastructure optimization, Europe requires compliance excellence, while Southeast Asia offers growth-cost alignment.

We recommend our three-phase approach: comprehensive data analysis, small-scale pilot implementation, and data-driven network optimization.

Our intelligent warehousing solutions combine industry expertise, technological innovation, and economies of scale to help build agile, efficient, and risk-resistant global supply chains.